The Best Guide To Hard Money Atlanta

Wiki Article

Indicators on Hard Money Atlanta You Need To Know

Table of ContentsHard Money Atlanta - QuestionsThe Ultimate Guide To Hard Money AtlantaThe Best Guide To Hard Money AtlantaA Biased View of Hard Money AtlantaWhat Does Hard Money Atlanta Do?Getting My Hard Money Atlanta To Work

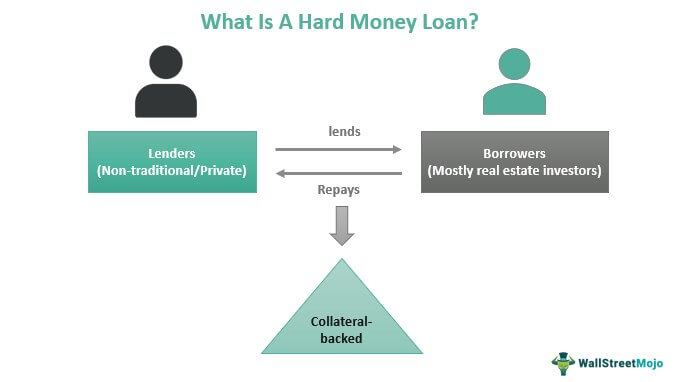

They are both supplied by independent capitalists such as companies and individuals. Both car loans are likewise structured with brief terms. Lenders additionally expect monthly interest-only repayments as well as a balloon settlement at the end of the lending. When it comes to interest rates, bridge fundings are somewhat reduced. The variety is normally in between 6% and also 10% for swing loan, while hard money lendings range from 10% to 18%.You can protect it also if you have a history of repossession. The residential or commercial property is signed as collateral, which is the only security a loan provider counts on in case you fail on your loan. Tough cash loan providers primarily determine loan authorization as well as terms based on the property made use of as collateral.

As for deposit, 20 percent to 30 percent of the financing quantity is required. Some tough money providers might need 10 percent down payment if you are a skilled home flipper. Expect a Reduced Loan-to-Value Ratio Most tough money lenders adhere to a lower loan-to-value (LTV) ratio, which is 60 percent to 80 percent.

Not known Facts About Hard Money Atlanta

The reduced LTV implies tough money loan providers do not give as much financing as conventional industrial resources. If you fail on your funding, a lending institution can count on selling your residential or commercial property swiftly. They might additionally have greater opportunities of recouping the lost funds. On the other hand, get ready for a number of downsides.Difficult money loans have a price of 10 percent to 18 percent. Meanwhile, conventional commercial lendings generally have rates between 1. 176 percent to 12 percent. In this regard, tough cash financing prices can be higher than subprime industrial financings. The raised price is a sign of the high risk lending institutions encounter when they use this sort of financing.

To provide you an example, let's say you obtained a hard money lending at $800,000 with 12 percent APR.

Utilizing the calculator over our page, let's estimate your regular monthly interest-only payment, principal and interest payment, and also complete balloon repayment. Repayment Type, Amount Interest-only settlement$8,000.

If you decide to make major repayments with rate of interest, it will cost $8,228 (hard money atlanta). 90 per month. By the end of the 2-year term, you must make a balloon settlement of $793,825. 75 to pay for your home loan. Difficult money car loans have actually here ended up being a common financing alternative for residence flippers who can not access business loans from financial institutions.

Hard Money Atlanta Things To Know Before You Get This

In other instances, a genuine estate offer might not pass strict guidelines from a standard lending institution. For these factors, house flippers turn to difficult cash lendings.Once they are able to make a sale, they can pay back the financing. On the various other hand, if a house flipper defaults, the hard money lender can seize or take possession of the building.

Hard Money Atlanta Fundamentals Explained

In other instances, when it concerns experienced residence flippers, lending institutions enable the interest to accumulate. A residence flipper can pay the interest together with the staying balance up until the term is through. Difficult cash loan providers might additionally not be as important with repayment. This holds true if your lending institution discovers an excellent chance to make benefit from your building.Higher interest rates is a major drawback for hard money lendings. In general, it costs more than traditional commercial lendings.

Getting The Hard Money Atlanta To Work

If you're source fee is 3 percent as well as your lending is $850,000, your source cost would certainly set you back $25,500. Some lending institutions might not give funding because of rigorous genuine estate conformity regulations.check this The most significant danger is losing your residential property. If you fail on your financing or fail to re-finance early, tough money loan providers can take your building and sell it on their own.

Lenders may not be as strict concerning settlement as financial institutions. They might still make a great revenue even if you back-pedal your lending. Some lenders might reject funding for owner-occupied residential property due to the fact that of stringent realty compliance rules. To touch difficult money car loan suppliers, you can obtain in touch with property agents and also investor teams.

Report this wiki page